PETALING JAYA: The Associated Chinese Chambers of Commerce and Industry of Malaysia (ACCCIM)’s Malaysia’s Business and Economic Conditions Survey (M-BECS) indicated a weakening trend in Malaysian business conditions and sentiment, driven by the US tariffs policy uncertainty, rising costs, and cooling global demand.

The half-yearly survey conducted between July 10 and Aug 11 covering business performance for January-June 2025 (1H’25) and expectations for July-December 2025 (2H’25) has drawn from 777 responses.

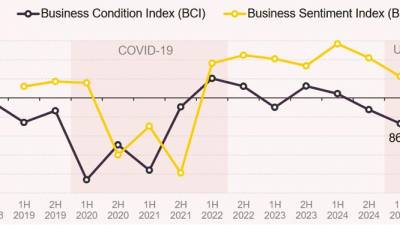

For the first time, the survey has introduced two new composite measures, namely Business Condition Index (BCI) and Business Sentiment Index (BSI). The BCI captures prevailing business performance trends, while the BSI reflects expectations going forward.

ACCCIM president Datuk Ng Yih Pyng said that businesses are cautiously pessimistic about economic and business prospects in 1H and 2H’25, weighed down by still-elevated and rising operating costs, slowing domestic and external demand as well as concerns over the heightened global uncertainties due to the tariffs.

He expressed deep concern that businesses face rising business costs during a period of high uncertainty in external environment.

He said businesses have cited multiple cost pressures emanating from higher minimum wages, mandatory employers’ EPF contributions for all non-citizen workers, starting October payroll, the expanded SST, especially the service tax on rental and construction works, port tariff hikes, electricity tariff adjustments, higher water tariffs, the petrol subsidy rationalisation to be implemented in September 2025, the planned introduction of a tiered foreign worker levy in 2026, and additional compliance costs from the implementation of e-invoicing.

Overall, respondents have maintained highly cautious expectations for the economy and business conditions in 2025. This is due to external and domestic headwinds such as the US’s tariff and recent domestic policy changes and measures that have increased the cost of doing business.

> BCI and BSI stood at 86.5 in 1H’25 and 97.4 in 2H’25 respectively, indicating overall businesses’ pessimism as both indices below the neutral threshold of 100. Both indices have been on downward trends since 2023/2024.

> 28.7% and 31.2% of respondents hold a pessimistic view on the economic and business conditions in 1H’25, respectively. Respondents’ pessimism continued in 2H’25, with 41% for economic conditions and 40% for business conditions.

> The top five factors that have adversely affected business performance in 1H’25 were – high operating cost (as voted by 54.8% of respondents); increase in prices of raw materials (42%); changing consumer behaviour (37.3%); declining business and consumer sentiment (37.1%); and cash flow problem (34.7%).

> Cash flow and debtor conditions were neutral in 1H and 2H’25.

> Domestic sales have declined in 1H’25, though there is a slight drop in the percentage of respondents anticipate a decline (40.4% in 2H’25 vs. 42.8% in 1H’25). For foreign sales, 38.5% of total respondents have reported neutral performance in 1H’25, while 37.6% expect a downturn in 2H’25.

> Production levels have declined in 1H’25, and is forecasted to persist in 2H’25.

> Cost of local and imported raw materials have increased in 1H’25 and is expected to continue increasing in 2H’25 though fewer respondents anticipate increases compared to 1H.

> Capital expenditure growth has slowed in 1H’25 compared to 2H’24, indicating a cautious investment outlook.

This survey has explored two current issues: Budget 2026, and Sales and Service Tax (SST) expansion.

Budget 2026

The respondents have listed “SMEs’ financing and capacity building” as Budget 2026’s main priority, as ranked by more than half of total respondents (56.3%). Targeted tax measures such as SMEs corporate income tax rebate and a higher threshold for the preferential 15% rate at RM1 million can help SMEs free up resources that may be reinvested into skills, productivity enhancement, and innovation. Tax-related measures also feature prominently, with tax credits, investment incentives (55.9%) and conducive tax reforms (53.1%) ranking high among areas businesses want the government to prioritise.

Ng highlighted the importance of maintaining Malaysia’s competitive corporate income tax rate to narrow the tax gap with our regional peers: Thailand and Vietnam each has a 20% corporate tax rate, Indonesia’s current tax rate is 22% and considering a reduction to 20%, while Singapore’s tax is maintained at 17%.

He emphasised that in making Malaysia’s tax and regulatory systems more competitive and business-friendly, the government can implement reforms that simplify compliance, reduce costs, and enhance transparency to boost Malaysia’s cost competitiveness on the world stage while driving innovation and investment.

AI and digital infrastructure ranked as the top area of Budget’s spending/investment as voted by 44% of respondents, underscoring the urgency of equipping businesses, particularly SMEs, with the AI tools to remain competitive.

Stronger support mechanisms are required to overcome the digital adoption barriers such as skills shortages, funding gaps, and limited access to technology, which are essential for helping SMEs integrate digital solutions into their operations and supply chains. Enhancing existing programmes such as the Digital Grant including higher allocation and allowing multiple claims instead of the current one-time limit, would provide more practical support.

Challenges in accessing government’s benefits and grants remain a major stumbling block. Businesses have cited complex procedures, unclear eligibility rules and lack of transparency as key barriers. By taking concrete steps to further simplify the applications process, provide clear guidelines and offer real-time transparency on approvals and the fund’s balances, the effectiveness of support measures would be greatly improved.

The expanded SST

This post-SST implementation survey revealed that 79.5% of respondents have reported higher business costs, 67.8% experienced reduced profit margins, and 49.1% faced heavier administrative burdens.

Among the major impacts are the new service tax on rental charges and construction contracts. Many businesses and industry associations have raised concerns regarding the poor timing and short notice of the expanded SST implementation, higher compliance and operational costs, potential effects on consumer demand, unclear regulations, and insufficient time for preparation.

Key challenges reported by businesses include ambiguous definitions and terminology (56.1%), difficult classification of taxable items (53.1%), and inconsistent official communi-cations (49.8%). In response to the expanded SST, 54.6% of businesses plan to pass increased costs to consumers, while 44.6% intend to absorb them internally.

In this regard, ACCCIM urges the government to raise the SST threshold of exemption to RM3 million, aligning it with the SMEs definition; temporarily reduce the service tax rate to 4% for new services (e.g. construction, leasing) for two years until 2027, and review subsequently when economic conditions stabilise; grant a 36-month exemption for all project types (except non-reviewable contracts), particularly to protect long-term infrastructure and property develop-ment projects; conduct a com-prehensive review with active stake-holders’ engagement, especially from the construction, services, and manufacturing sectors, to ensure smoother implementation and clearer guidance.